While the financial world continues its peculiar dance between tradition and innovation—often resembling a waltz performed in diving boots—Dubai has quietly positioned itself as the unlikely choreographer of this transformation. On July 8, 2025, the Dubai Financial Services Authority approved the QCD Money Market Fund (QCDT), marking the first tokenized money market fund within the Dubai International Financial Centre—a development that would have seemed fantastical to fund managers just a decade ago.

The collaboration between Qatar National Bank and blockchain fintech DMZ Finance represents more than mere technological novelty. QNB handles investment strategy and asset origination (the traditional heavy lifting), while DMZ Finance provides the blockchain infrastructure that transforms mundane money market assets into digital tokens. This division of labor suggests a pragmatic approach to innovation—leveraging existing expertise rather than reinventing the wheel with cryptocurrency enthusiasts.

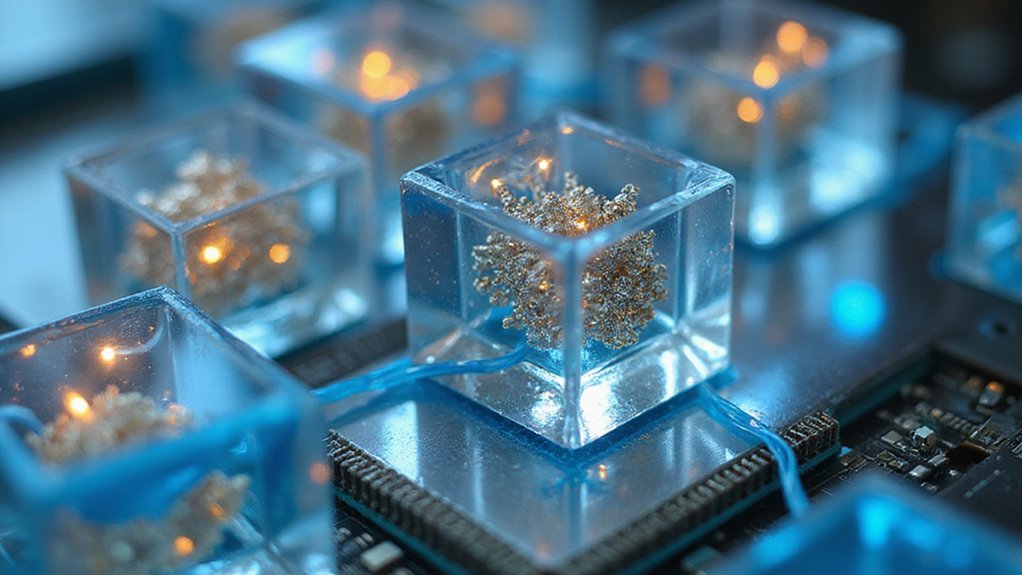

QCDT’s architecture addresses several institutional pain points through tokenization. The fund generates stable yields backed by real-world assets while offering on-chain transparency that traditional money markets conspicuously lack. Banks can deploy QCDT tokens as qualifying collateral for loans, centralized exchanges may utilize them as mapped collateral, and the tokens can serve as backing reserves for stablecoins—effectively creating a Swiss Army knife for digital finance infrastructure.

QCDT transforms traditional money market drudgery into a versatile digital instrument—part collateral, part reserve, wholly revolutionary infrastructure.

The regulatory implications extend beyond Dubai’s borders. As the European Union’s MiCA regulations tighten compliance requirements, the UAE’s more accommodating framework attracts displaced crypto ventures seeking jurisdictional arbitrage. Dubai’s approach—exemplified by the Department of Finance’s partnership with Crypto.com for government payments—signals a calculated embrace of digital assets rather than reflexive resistance.

The technical implementation enables real-time settlement and transparency of fund holdings, features that traditional money markets deliver with all the speed and clarity of continental drift. Investors can trade tokenized shares on digital exchanges under DIFC oversight, creating a regulated marketplace that bridges traditional finance with decentralized protocols.

This development positions Dubai not merely as a financial hub but as a laboratory for next-generation infrastructure—where the marriage of traditional banking with blockchain technology produces offspring that neither parent could have conceived alone. The emergence of tokenized real-world assets represents a fundamental shift in how ownership is structured across various sectors, with Dubai’s pioneering fund serving as a blueprint for similar innovations globally.