A staggering $10 trillion—roughly 10% of global GDP—stands poised for tokenization by 2027, yet the infrastructure supporting Real-World Assets (RWAs) remains frustratingly fragmented, riddled with regulatory ambiguities, and hampered by technical limitations that would make even the most patient institutional investor question whether the blockchain revolution has truly arrived or merely sent a strongly worded memo.

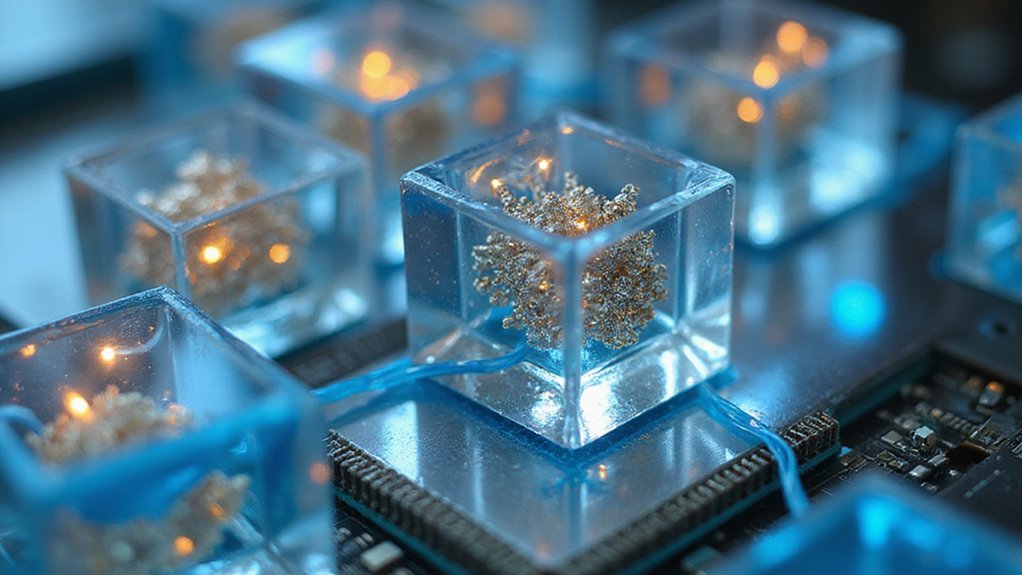

The fundamental premise of RWA tokenization appears deceptively simple: convert tangible assets like real estate, machinery, or copyrights into digital tokens that can be traded, fractionalized, and integrated into decentralized finance protocols. These digital “twins” theoretically democratize access to traditionally illiquid markets while enabling 24/7 trading and reducing transaction costs.

Converting tangible assets into digital tokens promises to democratize traditionally illiquid markets—if only reality matched the deceptively simple premise.

The reality, however, involves traversing a labyrinthine workflow spanning off-chain standardization, on-chain mechanisms, and marketplace integration—each phase presenting its own delightful complications.

Consider the off-chain standardization phase, where asset verification, ownership validation, and legal compliance must be meticulously documented before any blockchain interaction occurs. This process requires the kind of bureaucratic thoroughness that would make Kafka weep, involving multiple jurisdictions, regulatory frameworks, and valuation methodologies that somehow must align with smart contract logic.

The on-chain mechanism leverages ERC-20 standards and oracles (particularly Chainlink) to maintain real-world data connectivity, creating an automated system for ownership transfers and fractional trading. Yet this technical elegance masks underlying challenges: custody arrangements for physical assets, cross-border jurisdictional conflicts, and the perpetual question of accurate valuation in volatile markets. The legal enforcement of ownership rights continues to pose significant challenges, as the disconnect between digital tokens and physical assets creates risks where digital tokens may not guarantee access to the underlying real-world asset.

Special Purpose Vehicles (SPVs) serve as legal buffers, ostensibly mitigating financial risks while adding another layer of complexity to an already convoluted structure. Meanwhile, regulatory frameworks continue evolving at the speed of continental drift, leaving market participants to navigate uncertain legal terrain while attempting to capitalize on projected trillion-dollar opportunities. BlackRock’s entry into the RWA space through its Securitize partnership demonstrates how traditional financial giants are positioning themselves to capture this emerging market despite existing complexities.

The tokenization process promises enhanced liquidity, transparency, and democratized access to investment opportunities traditionally reserved for institutional players. However, achieving seamless interoperability between blockchain platforms and DeFi protocols remains an ongoing challenge, requiring infrastructure improvements that match the ambitious economic projections driving current market enthusiasm. As tokenized real-world assets continue reshaping ownership models across various sectors, the integration of traditional financial institutions with blockchain technology becomes increasingly critical for widespread adoption.