Parallel processing revolutionized cryptocurrency mining, transforming it from a hobbyist pursuit into an industrial-scale operation. By executing multiple cryptographic operations simultaneously, miners dramatically increase their chances of solving complex puzzles and securing digital rewards. GPUs, with their thousands of smaller cores, outperform CPUs in handling mining’s repetitive algorithms. This computational approach extends beyond hardware to structural innovations like mining pools, where resources aggregate across devices to function as unified entities. The technological arms race continues to intensify as miners pursue ever-more efficient parallel solutions.

The computational arms race that underpins cryptocurrency mining—that peculiar digital gold rush of our time—has transformed what was once a hobbyist pursuit into an industrial-scale operation requiring specialized hardware and sophisticated processing techniques.

At the heart of this evolution lies parallel processing, the technological cornerstone that enables miners to simultaneously execute multiple cryptographic operations, dramatically increasing their probability of solving the complex puzzles that yield digital rewards.

This parallelism, rather unsurprisingly, has become the sine qua non of profitable mining ventures.

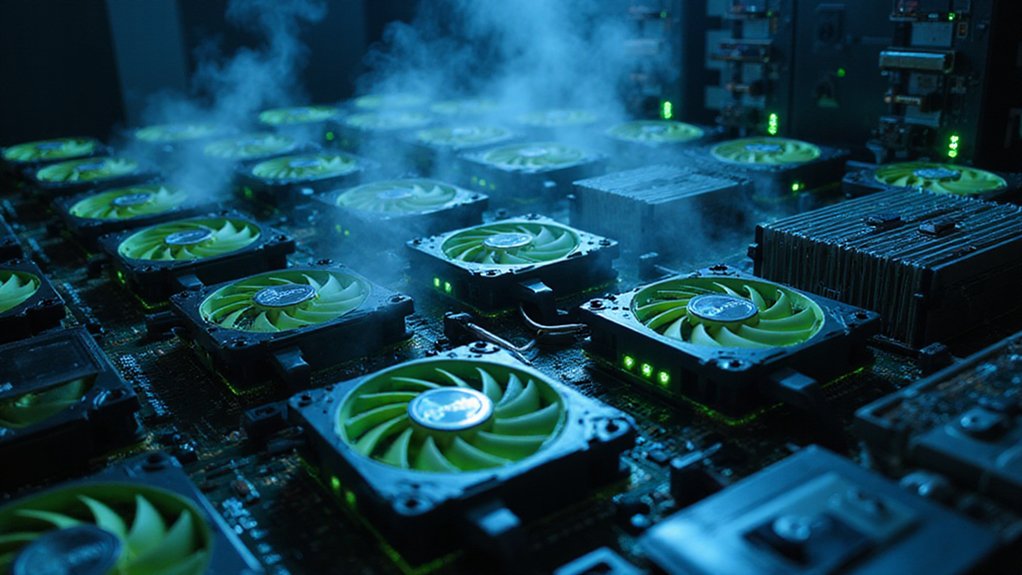

GPUs have emerged as the preferred hardware for cryptocurrency mining precisely because of their innate ability to handle parallel tasks with remarkable efficiency.

Unlike their CPU counterparts, which excel at sequential processing, GPUs deploy thousands of smaller cores designed specifically for concurrent operations—a perfect match for the mathematically repetitive nature of mining algorithms.

This architectural advantage translates directly into enhanced throughput and, by extension, greater mining efficiency.

The UTXO model employed by Bitcoin exemplifies how parallel processing principles can be embedded within a cryptocurrency’s fundamental design.

By treating each unspent transaction output as an independent entity, multiple transactions can be validated concurrently, provided they don’t attempt to spend the same outputs.

This approach—elegant in its simplicity yet powerful in execution—allows the network to process transactions in parallel without sacrificing security or consistency.

Mining pools represent perhaps the most visible manifestation of parallel processing’s impact, aggregating computational resources across countless devices to function as a unified mining entity.

These collaborative structures effectively distribute the computational burden, allowing participants with modest hardware to contribute meaningfully to the mining process (while accepting, of course, a proportionally reduced share of the rewards¹).

The competitive nature of crypto mining has led to the development of specialized computers that solve complex cryptographic puzzles to validate transactions on the blockchain network.

The scalability afforded by parallel processing has proven vital as network demands intensify, enabling mining operations to expand dynamically in response to market conditions.

The challenge of sequential execution in traditional blockchain architectures has fueled innovation in parallel mining approaches, as miners seek to overcome the throughput limitations that plague many networks.

Miners continuously solve complex mathematical problems to verify transactions and earn rewards, creating a competitive environment where individual interests align with network security through sophisticated game theory principles.

One might reasonably conclude that without parallel processing capabilities, the cryptocurrency ecosystem as we understand it would simply cease to function.

¹A necessary compromise in an increasingly competitive landscape.

Frequently Asked Questions

What Skills Are Needed to Build a Mining Rig?

Building a mining rig requires a multifaceted skill set spanning both technical and business domains.

One needs hardware installation expertise (motherboards, GPUs), system administration knowledge (particularly Linux), networking capabilities, and electronics familiarity.

Software proficiency—including coding, configuration, and algorithm understanding—proves equally essential.

Operational competencies encompass cooling system design, hardware selection, and power efficiency optimization.

Finally, successful miners must navigate procurement challenges, market fluctuations, and regulatory compliance—a peculiar blend of tech-savvy and financial acumen that few possess naturally.

How Much Electricity Does Parallel Mining Consume per Month?

Cryptocurrency parallel mining operations consume approximately 5.83-17.25 TWh monthly in the U.S., with Bitcoin mining alone accounting for an estimated 2.08-7.58 TWh.

These figures—staggering by any reasonable metric—vary based on utilization rates, which typically hover around 80%.

The precise consumption remains elusive due to operational fluctuations and regional variances, though the aggregate demand (peaking at 10,275 MW) places this digital gold rush on par with entire nations’ energy footprints.

Can Mining Damage Computer Hardware Over Time?

Cryptocurrency mining can indeed inflict cumulative damage on computer hardware through multiple vectors.

Heat stress from continuous operation accelerates component degradation, while power fluctuations and electrical demands place substantial strain on circuitry.

The unrelenting 24/7 operational cycle subjects GPUs and ASICs to premature aging, with cooling systems often proving inadequate for sustained computational loads.

Environmental factors—dust accumulation being particularly pernicious—exacerbate these issues, ultimately reducing hardware longevity in what amounts to a war of technological attrition.

Which Cryptocurrencies Are Most Profitable for Parallel Processing Mining?

For parallel processing mining profitability, Ravencoin (KawPow algorithm) and Zcash (Equihash) currently lead the pack, with their GPU-friendly designs yielding respectable returns.

Ethereum Classic maintains relevance despite its elder sibling’s shift to proof-of-stake, while privacy-focused Monero offers CPU-viable alternatives.

The emerging BlockDAG ecosystem targets home miners specifically.

One must, however, weigh algorithm compatibility against electricity costs and hardware efficiency—factors that relentlessly erode those tantalizing theoretical yields faster than market analysts update their projections.

Are There Environmental Regulations Specifically Targeting Cryptocurrency Mining?

Environmental regulations are increasingly targeting cryptocurrency mining, with New York leading the charge through pending legislation to ban new air permits for mining operations.

Federal initiatives propose thorough environmental reviews, potentially suspending all blockchain mining activities.

These regulatory efforts primarily target Proof-of-Work consensus mechanisms, citing concerns over energy inefficiency, greenhouse gas emissions, and cross-state air pollution that exposes millions to harmful PM2.5 particles—an evidence of mining’s somewhat unexpected emergence as an environmental policy battleground.