Crypto mining serves as the computational backbone of blockchain networks, validating transactions through a competitive process of solving complex mathematical puzzles. Miners deploy substantial computing power to perform Proof-of-Work calculations, receiving newly minted coins and transaction fees as rewards for their efforts. This resource-intensive activity transforms digital scarcity into economic value while simultaneously securing decentralized ledgers against fraudulent activities. The landscape has evolved from solo enthusiasts with personal computers to industrial-scale operations with specialized hardware—a fascinating journey through digital’s equivalent of the gold rush.

How exactly does a digital currency—essentially a series of ones and zeros floating in the ether—maintain its integrity without centralized oversight?

Enter crypto mining, the computational backbone of blockchain networks that validates transactions and fortifies the edifice of decentralized finance.

This process hinges on miners deploying substantial computational resources to solve complex mathematical puzzles—a mechanism known as Proof-of-Work (PoW)—thereby confirming transactions and adding new blocks to the chain approximately every ten minutes.

The competitive nature of mining creates a fascinating economic ecosystem: miners worldwide race to solve these cryptographic conundrums first, with successful participants rewarded with transaction fees and newly minted coins.

Mining transforms digital scarcity into economic competition—a global race where computational prowess converts electricity into financial reward.

(One might observe the delicious irony that digital scarcity is maintained through the very tangible scarcity of electricity and hardware.)

This incentive structure ingeniously aligns individual profit motives with network security objectives.

PoW originally pioneered by Bitcoin serves as cryptographic proof that honest computational work was performed, preventing fraud without relying on centralized authorities.

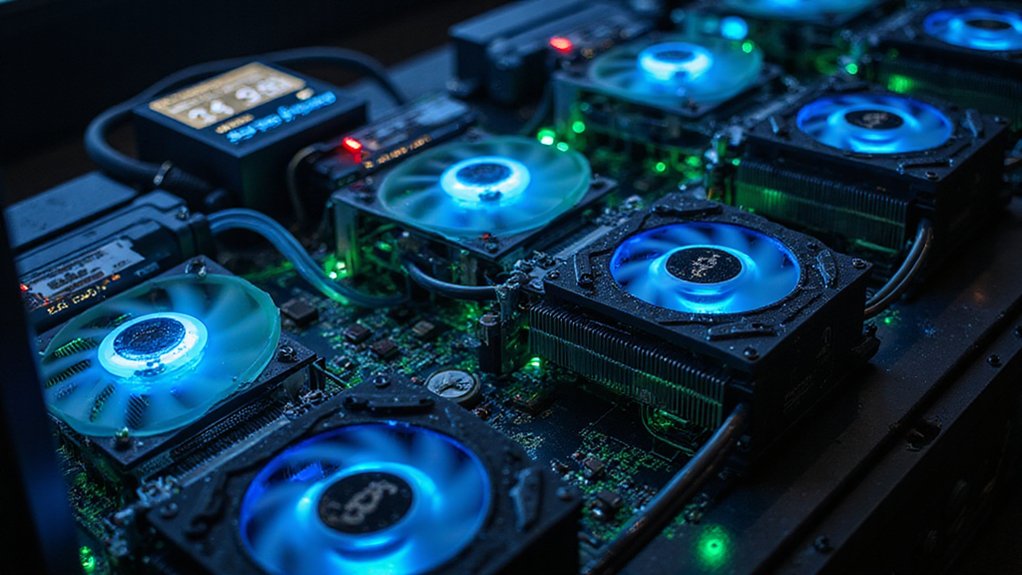

Mining operations manifest in various configurations, from solitary enthusiasts running specialized hardware in spare bedrooms to industrial-scale facilities housing thousands of Application-Specific Integrated Circuits (ASICs).

Many participants opt for pool mining, combining computational power to increase statistical chances of rewards—a pragmatic response to the increasingly prohibitive resource requirements of solo endeavors.

The environmental implications of this digital gold rush are not insignificant.

The substantial energy consumption has prompted valid scrutiny regarding carbon emissions, with mining operations increasingly gravitating toward regions offering inexpensive, often renewable energy sources.

This ecological dimension has catalyzed research into alternative consensus mechanisms like Proof-of-Stake, which substantially reduces energy requirements.

As regulatory frameworks evolve and market conditions fluctuate, the mining landscape continues to transform.

Technological advancements in hardware efficiency and cooling systems progressively alter the cost-benefit calculus for participants.

Despite these shifting parameters, the fundamental purpose remains unchanged: maintaining the security and integrity of a decentralized ledger system—a function traditionally performed by trusted intermediaries now elegantly replaced by cryptographic proof and economic incentives.

The diverse landscape of mining participants includes everyone from large companies with multiple facilities to individuals using personal computers and smartphones for smaller-scale operations.

Miners generate and test trillions of cryptographic hashes per second in their quest to find a value that meets or falls below the network’s target hash, legitimizing new transaction blocks.

Frequently Asked Questions

How Much Electricity Does Crypto Mining Typically Consume?

Cryptocurrency mining consumes staggering amounts of electricity—Bitcoin alone demands between 155-172 terawatt-hours annually (comparable to Poland’s entire national consumption).

In the U.S., crypto operations account for 0.6-2.3% of national electricity usage, consuming approximately 70 TWh yearly at 80% utilization.

These energy-intensive operations—running continuously and often drawing from fossil-fuel sources—strain electrical grids with their industrial-scale demands, prompting inevitable questions about sustainability as their carbon footprint continues to expand.

What Are the Best Cryptocurrencies for Beginners to Mine?

For newcomers to mining, ASIC-resistant cryptocurrencies offer the most accessible entry points.

Monero stands out with its CPU-friendly RandomX algorithm and steady rewards (~0.6 XMR per block).

Ravencoin presents another viable option, delivering generous block rewards (2,500 RVN) via the KAWPOW algorithm.

Kaspa, with its lightning-fast one-second block times, provides frequent payouts that can buoy beginner morale.

Those seeking simplicity might consider cloud mining platforms like SpeedHash, which eliminate hardware headaches altogether.

Can Mining Damage My Computer Hardware Over Time?

Cryptocurrency mining can indeed damage computer hardware over time.

The process—which demands continuous high-performance computing—generates substantial heat that, when inadequately managed, accelerates component degradation.

GPUs and CPUs suffer particularly, with shortened lifespans resulting from thermal stress, overclocking, and power fluctuations.

Additionally, fans endure accelerated wear from constant operation.

Professional miners mitigate these risks through specialized cooling systems and proper power management—luxuries most hobbyists’ setups lack (rendering the “occasional mining” argument somewhat dubious).

Is Crypto Mining Still Profitable in Today’s Market?

Crypto mining profitability in 2025 exists in a bifurcated reality: industrial operations with sub-$0.04/kWh electricity contracts and cutting-edge ASICs remain viable (albeit with thinning margins post-halving), while small-scale miners face near-insurmountable hurdles.

The inexorable rise in global hash rate, coupled with the halved block rewards, has rendered the once-democratic pursuit increasingly plutocratic.

Profitable mining now demands scale economies, strategic coin-switching, and geographically-advantaged operations—a far cry from the halcyon days of profitable laptop mining.

Are There Any Eco-Friendly Alternatives to Traditional Mining Methods?

Eco-friendly alternatives to traditional mining methods have emerged as sustainability concerns mount.

Proof-of-Stake systems reduce energy consumption by 99% compared to Proof-of-Work, while renewable energy-powered operations leverage solar, hydro, and nuclear sources.

Green mining pools prioritize carbon neutrality through collective environmental commitments.

Heat recycling initiatives transform mining’s thermal waste into valuable inputs for agriculture and heating.

These approaches (increasingly necessary as climate scrutiny intensifies) transform cryptocurrency’s environmental pariah status without sacrificing blockchain integrity or profitability.